The realm of currency trading stands as a labyrinth of intricate interactions, where riches can flourish or dissipate with the changing tides. This article embarks on an expedition through the historical corridors of finance, unraveling the captivating saga of major currency players as they traversed the path from obscurity to supremacy.

The Birth of Giants: Establishing Dominance

The inception of every currency, no matter how potent it eventually becomes, resides in the realm of the humble. This section delves into the embryonic stages of dominant currencies, tracing the footprints they left as they surged forward to assert their dominance on the global stage.

Economic Powerhouses: The Dollar’s Reign

The United States dollar, an emblem of economic prowess, has stood resolute as the bedrock of the world’s reserve currency. Unpacking the forces that have solidified its ascendancy, this section sheds light on the multifaceted elements that have anchored the dollar’s reign.

- Euro: Uniting Currencies: The euro, a unifying force in the mosaic of European currencies, has grappled with a destiny marked by both unity and divergence. Here, we dissect the intricate genesis of the euro, its trials and triumphs, and its place within the modern financial narrative.

- Yen: The Strength in Stability: The Japanese yen, a paragon of stability in tumultuous times, carries a tale of resilience etched across the fabric of economic upheavals. This section peers into the historical annals, unearthing the profound significance of the yen and its role as a pillar of stability in global trade.

- Pound Sterling: The trajectory of the British pound sterling is one adorned with centuries of endurance. This segment embarks on a voyage through time, unraveling the sterling’s narrative from its zeniths to its vulnerabilities amidst the contemporary currents of the market.

Ripple Effect: The Impact of Cryptocurrencies

The disruptive emergence of cryptocurrencies has jolted the foundations of traditional currency paradigms. In this section, we dissect the intricate threads of influence these digital assets weave, probing the ascent of Bitcoin and the potential ramifications across the financial spectrum.

Pitfalls and Downfalls: Learning from History

The chronicles of currency history are etched with instances of abrupt collapses and crises. This segment delves into the annals of past setbacks, gleaning valuable insights to illuminate the path toward averting future economic cataclysms.

Market Trends: Navigating the Present

In a realm where vigilance is paramount, staying attuned to contemporary market trends is indispensable for traders. This section extends a guiding hand, furnishing readers with insights into recent currency market metamorphoses and their ripple effects on trading strategies.

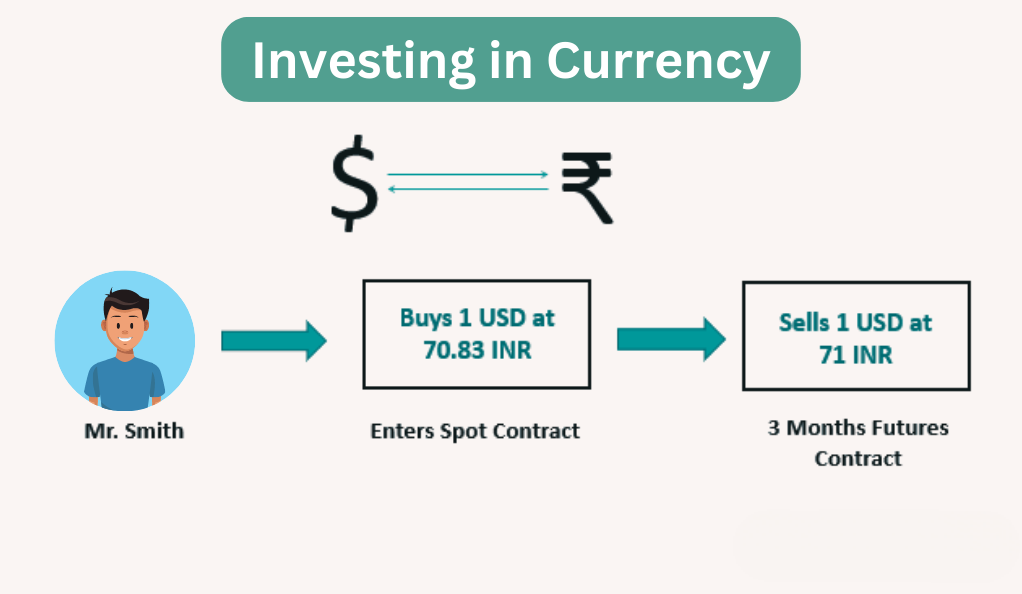

Currency Diversification: Your Investment Strategy

Diversification, the linchpin of risk mitigation, emerges as a cardinal principle in the realm of currency trading. This segment unfurls the strategy of asset allocation across diverse currencies, a tactical maneuver aimed at shielding investments from the tempestuous throes of volatility.

Future Speculations: Who Holds the Crown?

The enigmatic canvas of currency dominance unfurls an array of possibilities, each laden with its own intrigue. In this section, we cast our gaze toward the horizon, contemplating potential contenders and seismic shifts that could redefine the global currency hierarchy.

Global Events and Currency Shifts

The cadence of global events echoes through the corridors of currency markets, instigating seismic shifts in valuation. This segment illuminates the intricate dance between geopolitical occurrences and currency values, coupled with strategies for traders to navigate these tides.

The Psychology Behind Market Movements

The undercurrents of market psychology exert an indelible influence on currency movements. This section delves into the intricate tapestry of human behavior that weaves its threads into the fabric of currency trading, deciphering the enigma that drives market rhythms.

Risk Management: Safeguarding Your Investments

Nurturing investments in the currency domain demands a vigilant approach toward risk management. This segment assumes the mantle of a guide, furnishing traders with actionable strategies to prudently navigate the treacherous waters of currency volatility.

Conclusion

As we cast our gaze back on the chronicles of currency, the tapestry woven is one replete with insights and revelations. The rise and fall of these colossal currency players bear witness to the symphony of history, trends, and human psychology that collectively script the narrative of global finance.

FAQs

Geopolitical events inject uncertainty into markets, compelling investors to recalibrate their positions, thereby sculpting currency valuations.

Indeed, diversification emerges as a bulwark against undue risk exposure, distributing investments across currencies to stave off the impact of volatility.

Cryptocurrencies, while a formidable disruptor, grapple with challenges on regulatory and technological fronts, rendering a complete replacement speculative.

Central banks orchestrate the financial symphony through strategic monetary policy decisions, rippling through interest rates and consequently molding currency trajectories.

Staying abreast of currency market trends necessitates diligent engagement with financial news, expert analysis, and insights, fostering an informed vantage point.

ACDX.io aims to provide balanced and reliable information on cryptocurrency, finance, trading, and stocks. However, we refrain from offering financial recommendations and encourage users to conduct their own research and thorough verification.

Read More