In recent years, a remarkable shift has been observed in the world of investing. Investors are no longer solely focused on maximizing financial gains; they are also placing increasing emphasis on ethical considerations and social impact. This transition from traditional investing to ethical investing has led to the rise of “moral investing,” where financial decisions are aligned with personal values and societal well-being. In this article, we will delve into the concept of moral investing, its origins, principles, and the positive influence it wields in shaping the global economy.

Contents

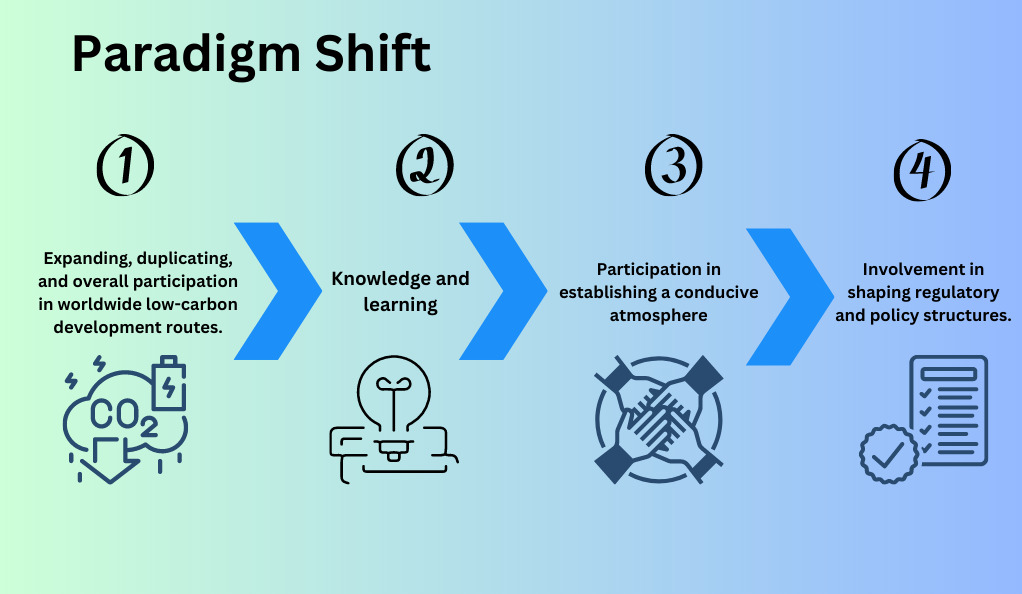

Understanding Moral Investing: A Paradigm Shift

The traditional approach to investing has often prioritized financial returns above all else. However, this mindset has given way to a new approach known as moral investing. This paradigm shift stems from the realization that investments can and should be vehicles for positive change. Investors are now considering not just the profitability of their investments, but also the environmental, social, and governance (ESG) factors associated with them.

The Origins of Moral Investing

The roots of moral investing can be traced back to various social movements, such as environmental activism, labor rights, and human rights advocacy. These movements spurred awareness about the impact of corporations on society and the environment. As a result, investors began seeking alternatives that align with their values, leading to the development of socially responsible investing (SRI) strategies.

Principles of Moral Investing

Moral investing operates on several core principles that guide investment decisions:

1. Ethical Screening

Investors conduct thorough research to identify companies that uphold ethical practices, respect human rights, and contribute positively to society.

2. Environmental Sustainability

Environmental considerations are paramount, as investors assess companies’ ecological footprint and commitment to sustainable practices.

3. Social Impact

Investments are directed towards companies that prioritize social welfare, diversity, and fair labor practices.

4. Governance and Transparency

Companies with strong governance structures and transparent operations are favored, as they demonstrate accountability to stakeholders.

The Social Impact of Moral Investing

Moral investing has far-reaching social implications. As investors allocate capital to socially responsible companies, these businesses gain resources to drive positive change. This, in turn, encourages other corporations to adopt ethical practices to attract investment. The collective influence of ethical investors can transform industries, promoting responsible business conduct on a global scale.

Aligning Trading Practices with Ethics

Investors seeking to transition into moral investing should follow these steps:

1. Self-Assessment

Identify personal values and causes that matter most, whether it’s environmental conservation, human rights, or fair labor practices.

2. Research

Thoroughly research companies’ ESG performance to ensure alignment with chosen values.

3. Diversification

Spread investments across various industries to minimize risk and maximize impact.

4. Long-Term Perspective

Moral investing often involves holding investments for the long term to facilitate positive change.

Contributing to the Global Economy: A Holistic Approach

Moral investing contributes not only to individual portfolios but also to the global economy. By supporting companies that prioritize sustainability and ethical practices, investors indirectly drive economic growth while fostering a more just and equitable society.

Conclusion

The rise of moral investing represents a significant shift in the investment landscape. As investors increasingly consider ethical, social, and environmental factors alongside financial returns, they are reshaping the dynamics of corporate behavior and influencing the global economy. By aligning trading practices with personal values, investors can actively contribute to positive change while enjoying potentially favorable financial outcomes.

FAQs

Moral investing, also known as ethical investing, involves making financial decisions that align with personal values and social impact goals.

Traditional investing primarily focuses on financial gains, while moral investing integrates ethical, social, and environmental considerations into investment decisions.

ESG stands for environmental, social, and governance factors, which are used to assess a company’s performance in terms of sustainability and ethical practices.

Yes, moral investing can yield favorable financial returns while also contributing to positive societal and environmental outcomes.

Begin by identifying your core values, researching companies’ ESG performance, and diversifying your investments across industries that align with your values.

ACDX.io aims to provide balanced and reliable information on cryptocurrency, finance, trading, and stocks. However, we refrain from offering financial recommendations and encourage users to conduct their own research and thorough verification.

Read More