Navigating the turbulent waters of trading isn’t just about the technical know-how. It’s a psychological journey, one that requires mindfulness and balance. This article is your guide to embracing the Zen approach to trading, equipping you with tools to manage your emotions and maintain stability, even when the market offers anything but.

The Mindset of a Trader

Trading isn’t merely an act of buying and selling; it’s a deeply mental and emotional engagement. Successful traders understand that their mindset can make or break their performance.

The Emotional Rollercoaster

Every trader, novice or expert, knows the stomach-churning feeling of market volatility. One moment you’re on top of the world as your stocks soar, the next, you’re plummeting into the depths of uncertainty. But what if you could enjoy the highs and navigate the lows with a sense of calm? Developing a keen sense of mindfulness allows traders to ride the rollercoaster with grace, maintaining their composure regardless of where the tracks lead.

From Fear to Greed – The Two Extremes

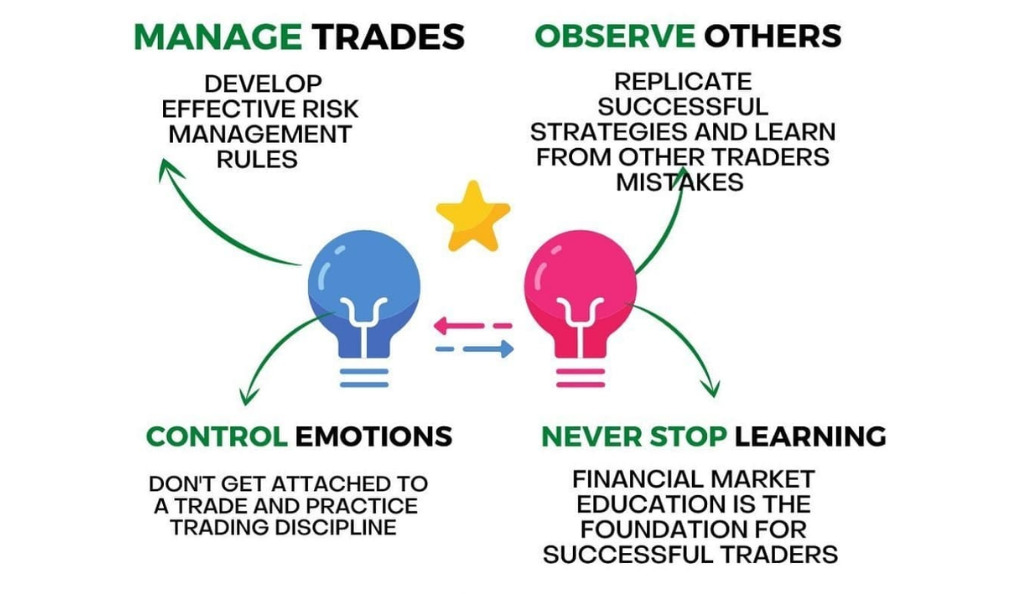

Fear and greed, they’re the two driving emotions behind most trading decisions. While fear can lead to missed opportunities, greed can result in rushed, regrettable decisions. By recognizing and understanding these emotional extremes, traders can strike a harmonious balance, making decisions that are informed, considered, and rational.

Emotional Intelligence in Trading

Emotional intelligence is not just a buzzword; it’s a critical tool in a trader’s arsenal. When wielded effectively, it can transform the trading game.

- Understanding Yourself: To master the market, one must first master oneself. By taking the time to introspect and recognize personal emotional triggers, traders can preemptively tackle irrational decisions. It’s like setting up an internal alarm system that buzzes whenever emotions threaten to take the steering wheel.

- Navigating Market Emotions: Markets have moods. Some days they’re exuberant, while other times they’re gloomy. The key for traders is not to mirror these emotions but to remain a steady observer. By maintaining an objective view, traders can act based on strategy and insight rather than getting swept up in the market’s emotional currents.

Stress Management Techniques for Traders

Amidst the rush of trading, it’s crucial to have mechanisms in place to manage stress and maintain clarity.

- Breathwork and Meditation: The simple act of controlled breathing can ground a person, bringing them back to the present moment. By integrating breathwork and meditation practices into their routine, traders can clear their minds, making space for informed decisions. It’s like defogging a window, allowing for a clearer view of the landscape beyond.

- Work-Life Balance and Breaks: Diving deep into the trading world is enticing, but immersion without breaks can lead to burnout. By ensuring a balanced work-life rhythm and allowing oneself the luxury of breaks, traders can come back to the market with renewed vigor and perspective.

Building a Winning Attitude

A positive attitude doesn’t just enhance a trader’s experience; it can also shape outcomes.

Growth Mindset

Trading, like life, is a series of ups and downs. By adopting a growth mindset, every setback becomes an opportunity for learning, and every success, a stepping stone to further growth. It transforms the trading journey from a series of isolated events to a continuous learning curve.

Embracing Losses

Losses, while challenging, offer invaluable insights. Instead of viewing them as failures, if traders see them as lessons, the entire narrative changes. It’s akin to turning stumbling blocks into stepping stones on the path to success.

Trading with Grace and Confidence

Confidence, when paired with knowledge and strategy, can be a trader’s strongest ally.

Learning from Mistakes: Every mistake, big or small, carries a lesson. By reflecting on these lessons and adapting strategies accordingly, traders can evolve, ensuring they’re better equipped for future challenges. It’s like refining a technique after each rehearsal, ensuring a stellar final performance.

Celebrating Small Wins: In the vast landscape of trading, it’s easy to overlook small victories, but these are the milestones that pave the way to larger successes. By celebrating these wins, traders fuel their motivation and drive, ensuring they’re always ready for the next challenge.

Conclusion

The Zen of trading transcends technical expertise. It delves deep into the realm of mindset, emotional intelligence, and self-awareness. By embracing this holistic approach, traders can navigate the market’s tumultuous waves with grace, poise, and unwavering confidence.

FAQs

Start with self-awareness, recognize your emotional triggers, and practice meditation or mindfulness exercises.

No, losses can offer invaluable lessons that, when learned from, can improve future trading strategies.

It’s subjective, but regular short breaks during the day and longer breaks after intense trading sessions can be beneficial.

Absolutely! Meditation helps improve focus, reduces impulsiveness, and enhances decision-making.

Yes, acknowledging small victories can boost confidence and motivate you to stay committed to your strategies.

ACDX.io aims to provide balanced and reliable information on cryptocurrency, finance, trading, and stocks. However, we refrain from offering financial recommendations and encourage users to conduct their own research and thorough verification.

Read More