Investing in the stock market can be a daunting task, especially for novice investors who are just starting out. However, by understanding some key stock market basics, beginners can gain a solid foundation and make informed investment decisions. In this article, we will explore the fundamental insights and essential concepts that every novice investor should know before venturing into the world of stock market investing.

Understanding the Stock Market: A Beginner’s Guide

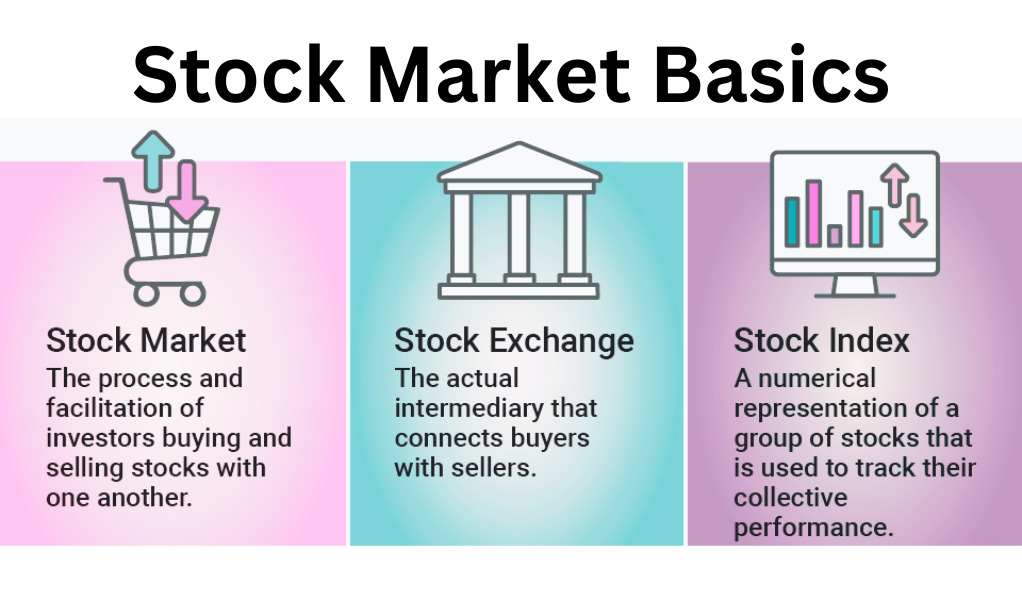

The stock market is a platform where buyers and sellers come together to trade shares of publicly listed companies. It serves as a marketplace for investors to buy or sell stocks, which represent ownership in a particular company. When a company goes public, it offers shares of its stock to the public through an initial public offering (IPO). Once the shares are listed on the stock exchange, they can be freely bought and sold by investors.

Investors participate in the stock market with the goal of making a profit. They can earn money through capital appreciation, where the value of their stocks increases over time, or through dividends, which are a portion of a company’s profits distributed to shareholders. However, investing in the stock market also comes with risks. Stock prices can be volatile and can fluctuate due to various factors such as economic conditions, company performance, and market sentiment.

To make investment decisions in the stock market, it is crucial for novice investors to understand the basic concepts and terminology associated with stock market investing. By familiarizing themselves with these essential principles, investors can navigate the market more confidently and make informed decisions.

Essential Concepts and Terminology for Novice Investors

- Stocks: Stocks, also referred to as shares or equities, represent ownership in a company. When investors buy stocks, they become shareholders and have the potential to earn profit through capital appreciation and dividends.

- Indices: Stock market indices, such as the S&P 500 or Dow Jones Industrial Average, are measures of the overall performance of a group of stocks. They provide insights into the market’s health and can be used as benchmarks for comparing the performance of individual stocks or portfolios.

- Bull and Bear Markets: Bull and bear markets describe the overall sentiment in the stock market. A bull market refers to a period of rising stock prices and general optimism, while a bear market signifies a period of declining stock prices and pessimism.

Understanding these concepts and terminology is essential for novice investors to communicate effectively with brokers, financial advisors, and fellow investors. It also enables them to interpret market trends and make informed investment decisions.

By grasping the fundamental insights and key stock market basics discussed in this article, novice investors can embark on their investment journey with greater confidence. Remember, stock market investing requires careful consideration and research. It is always recommended for beginners to seek guidance from professionals or educate themselves further to ensure they make informed investment choices. With knowledge and patience, novice investors can navigate the stock market successfully and work towards achieving their financial goals.

ACDX.io aims to provide balanced and reliable information on cryptocurrency, finance, trading, and stocks. However, we refrain from offering financial recommendations and encourage users to conduct their own research and thorough verification.

Read More